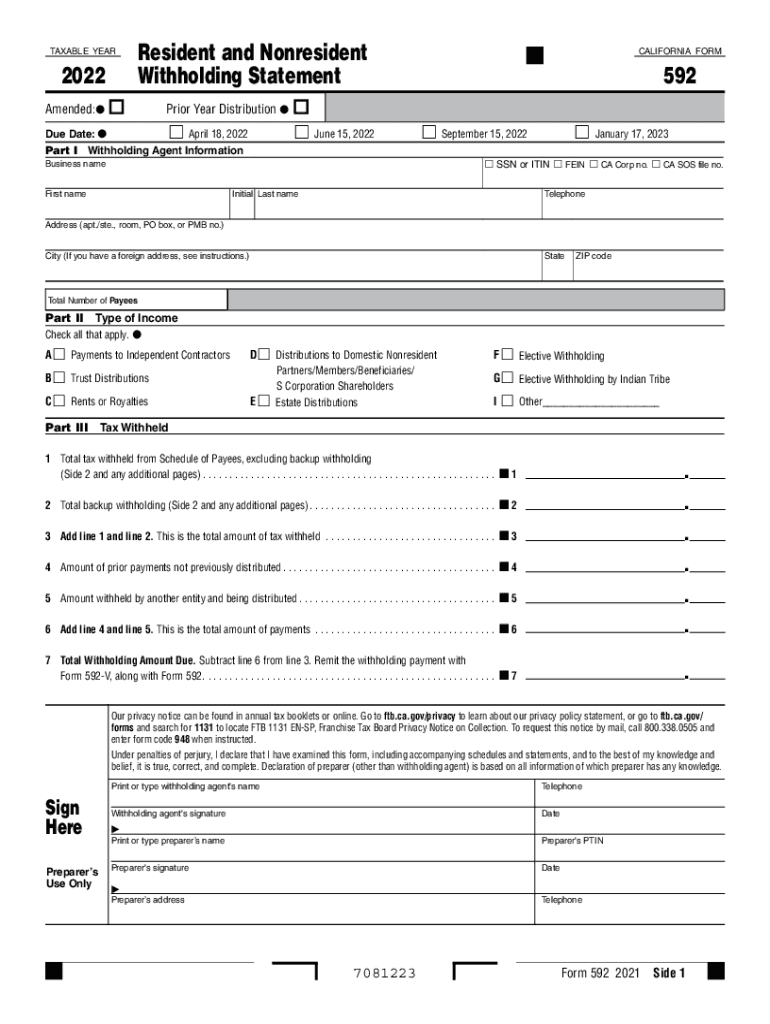

California Tax Withholding 2025. The form helps your employer. April 15 is the normal annual personal income tax (pit) payment deadline.

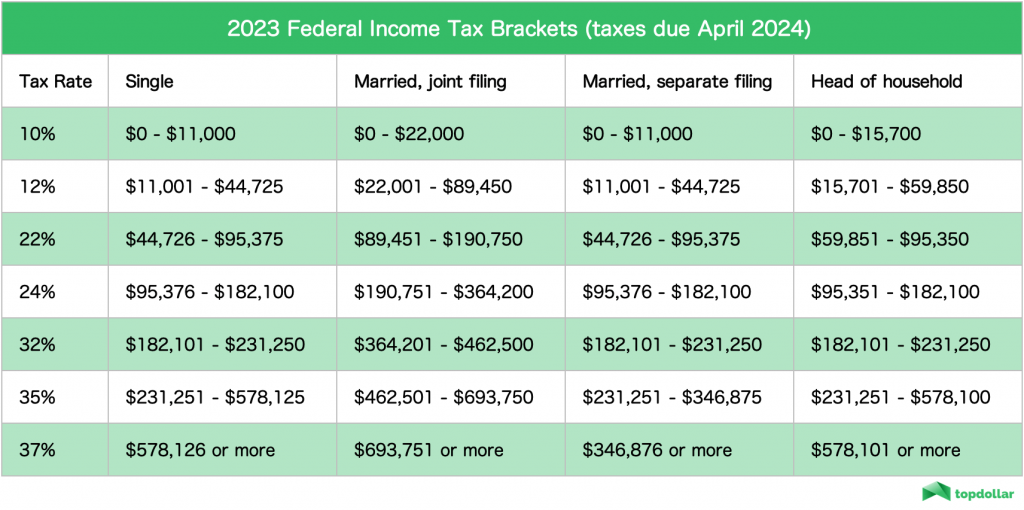

California has nine state income tax rates, ranging from 1% to 12.3%. Senate bill 951 (sb 951), which takes effect january 1, 2025, introduces several amendments to california’s unemployment insurance code and to state disability.

The california state tax calculator (cas tax calculator) uses the latest federal tax tables and state tax tables for 2025/25.

California Tax Brackets 2025 Chloe Carissa, The top california income tax rate has been 13.3%. To estimate your tax return for 2025/25, please select.

2025 Tax Brackets California, Calculate your tax using our calculator or look it up in a table of rates. The undersigned certify that, as of june 13,.

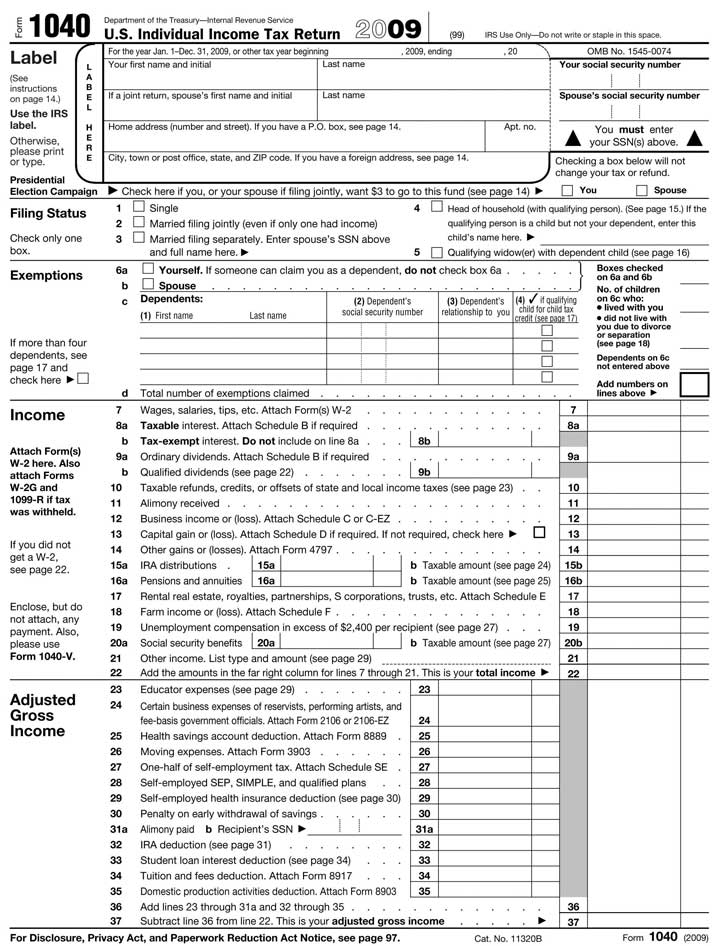

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The amount of income subject to tax. Use our income tax calculator to estimate how much tax you might pay on your taxable income.

California Personal Tax Withholding Form, California’s withholding methods will be updated for 2025, an official from the state employment development department said oct. We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding.

California state tax form Fill out & sign online DocHub, The top california income tax rate has been 13.3%. The form helps your employer.

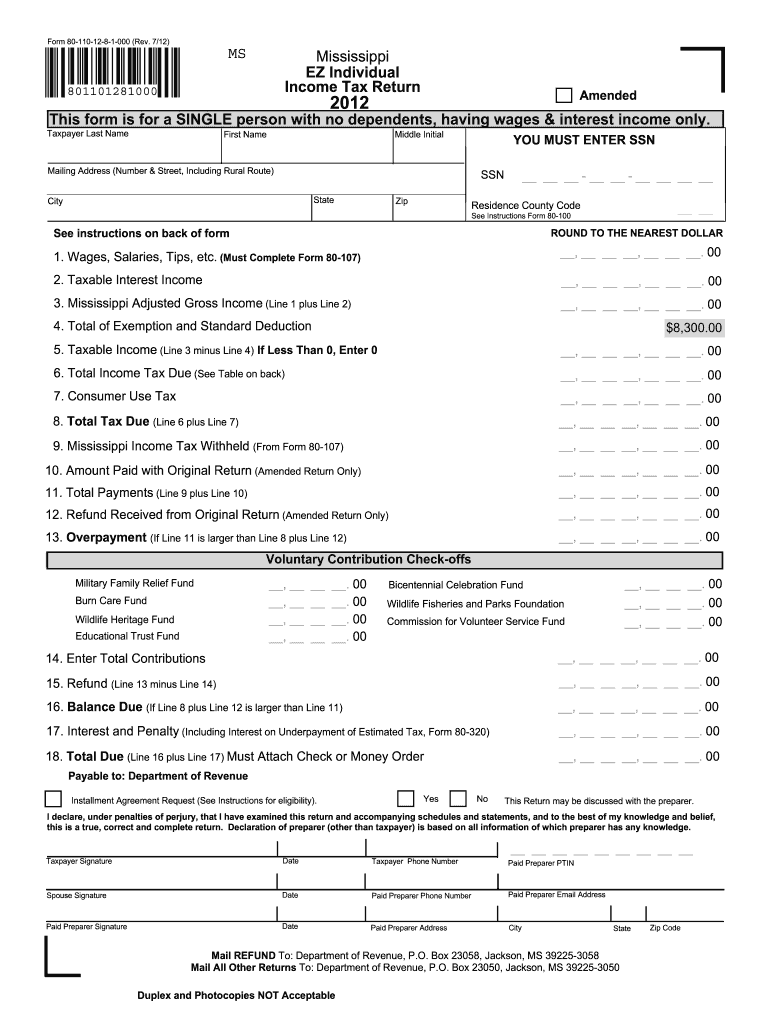

Ms state tax refund Fill out & sign online DocHub, Your california tax rate and tax bracket depend on your taxable income and filing status. The deadline to file a california state tax return is april 15, 2025, which is also the deadline for federal tax returns.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Senate bill 951 (sb 951), which takes effect january 1, 2025, introduces several amendments to california’s unemployment insurance code and to state disability. To estimate your tax return for 2025/25, please select.

California State Tax Brackets 2025 Caron Clementia, The deadline to file a california state tax return is april 15, 2025, which is also the deadline for federal tax returns. Use our income tax calculator to estimate how much tax you might pay on your taxable income.

Federal Tax Withholding 2025 Kaile Marilee, Employee withholding amount required for remittal: The de 4 form, or employee’s withholding allowance certificate, is used by california employees to determine the number of withholding allowances they claim for state tax.

2025 California Withholding Form Printable Forms Free Online, However, with the passing of senate bill 951, employees earning above that income will be taxed as well. The amount of income subject to tax.

Figure out your net pay gross income − (total income tax liability + total payroll tax liability + total pre.